Tradução e análise de palavras por inteligência artificial

Nesta página você pode obter uma análise detalhada de uma palavra ou frase, produzida usando a melhor tecnologia de inteligência artificial até o momento:

- como a palavra é usada

- frequência de uso

- é usado com mais frequência na fala oral ou escrita

- opções de tradução de palavras

- exemplos de uso (várias frases com tradução)

- etimologia

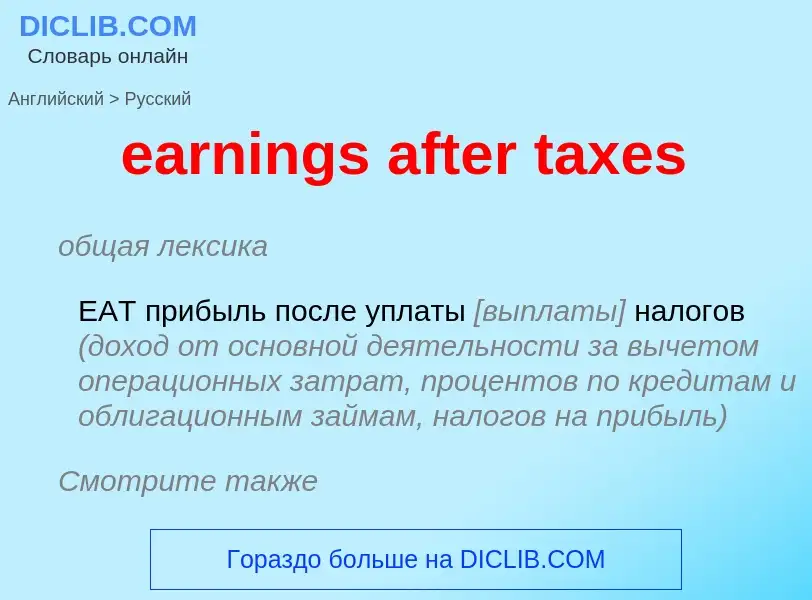

earnings after taxes - tradução para Inglês

общая лексика

EAT прибыль после уплаты [выплаты] налогов (доход от основной деятельности за вычетом операционных затрат, процентов по кредитам и облигационным займам, налогов на прибыль)

Смотрите также

сокращение

earnings before interest

taxes

depreciation and amortization

общая лексика

EBITDA прибыль до (вычета) процентов [процентных выплат]

налогов и амортизации [амортизационных отчислений] (прибыль компании от основной деятельности до вычета налоговых выплат, процентов по кредитам и облигационным займам и амортизационных отчислений)

Definição

Wikipédia

In corporate finance, net operating profit after tax (NOPAT) is a company's after-tax operating profit for all investors, including shareholders and debt holders. NOPAT is used by analysts and investors as a precise and accurate measurement of profitability to compare a company's financial results across its history and against competitors.

When calculating NOPAT, one removes Interest Expense and the effects of other non-operating activities (non-recurring gains and losses) from Net Income to arrive at a value that approximates the value of a firm's annual earnings. NOPAT is precisely calculated as:

NOPAT = (Net Income - after-tax Non-operating Gains + after-tax Non-operating Losses + after-tax Interest Expense)

NOPAT doesn’t include one-time losses and other non-recurring charges, because they don’t represent the true, ongoing profitability of the business. For example, a company may incur acquisition costs that would not be expected to occur in the future. These costs would negatively affect current year earnings, but do not accurately portray the operations of the firm. These costs should be excluded when performing any type of analysis to determine the operating and financial efficiency of a firm or to compare performance against other firms.

For a rough calculation, NOPAT approximates earnings before interest after taxes (EBIAT).

The rough calculation for NOPAT is: NOPAT = Operating profit x (1 - Tax Rate)

NOPAT is frequently used in calculations of Economic value added and Free cash flow.